The latest proposal from Centers for Medicare & Medicaid Services (CMS) to increase 2027 Medicare Advantage payments by 0.09% barely registered as good news for insurers.

For providers—especially hospitals, physician groups, and rural healthcare systems—it sent a signal that reimbursement pressure is about to intensify.

But unlike insurers, providers won’t see the impact show up in headlines or stock charts. It will show up in their accounts receivable (AR), denial rates, underpayments, which are directly tied to their revenue cycle management (RCM) efficiency.

This isn’t new either. It’s a reimbursement pattern providers are familiar with—and one that healthcare CFOs and RCM leaders should be preparing for now to get ahead of it.

When a Payer Concern Becomes a Provider Problem Too

When Medicare Advantage payments made to insurers fail to keep pace with rising medical costs, insurers have limited levers.

They can’t renegotiate what CMS pays them. What they can do is become more aggressive downstream—but changing how, when, and under what conditions they pay providers.

And that’s when providers start to feel the pressure—not in rate sheets, but in claim denials, silent underpayments, and slower cash.

From an RCM standpoint, this is a familiar cycle. What’s different now is how expensive and risky it’s become to manage this pressure with traditional AR workflows.

Historically, with insurers have responded to Medicare Advantage policy shifts by:

None of these have ever been labeled as “rate cuts.” But the net impact on providers remained the same: slower, less predictable cash.

Prior Authorization: Another Revenue Risk Leaders Can’t Ignore

Payment pressure isn’t the only force at play. According to Kaiser Family Foundation, Medicare Advantage insurers made nearly 53 million prior authorization determinations in 2024 alone—a clear sign of how aggressively payers are managing utilization and reimbursement.

For providers, this translates into:

Interestingly, more than 80% of denied prior authorization requests that were appealed in 2024 were subsequently overturned, underscoring how critical strong appeal workflows and claim prioritization in AR management play in today’s reimbursement landscape.

What Healthcare Providers Feel First—and Often Quietly

From the RCM frontlines, the downstream effects tend to surface quickly—and often quietly.

- Higher Denials that Look Legitimate

Denials shift from looking those from “obvious errors” to something originating from “technical or documentation-based.” And for the same reason, they often take longer to appeal, require more manual effort, and frequently get deprioritized when teams are stretched.

- More Silent Underpayments

Underpayments increase when insurers recalibrate reimbursement logic or apply stricter interpretations of contracts. Because these claims are technically “paid,” they often bypass denial workflows entirely.

- Slower AR Velocity

Providers generally don’t see an immediate spike in AR days. Instead, they start seeing:

- More follow-ups lining up

- Longer payer response times

- Higher effort for the same dollars collected

- Higher Cost to Collect

When insurers push back, providers respond with more manual work—more follow-ups, more appeals, more staff time—driving up operating costs without improving yield.

Why Traditional AR Management Breaks Down Under Pressure

When payer scrutiny increases, many providers fall back on familiar practices:

- Prioritizing the oldest AR (instead of the most recoverable claims)

- Adding follow-ups (that consume staff time on touches that won’t pay off)

- Missing line-level discrepancies (buried in remittance files)

And that flaw is structural. In reality, not all AR is equally recoverable and many underpayments don’t even enter denial workflows—and that’s why not all effort produces cash.

Without AI-powered revenue intelligence and insight into recoverability, likelihood, and payer behavior, effort gets misallocated.

High-value opportunities sit untouched while teams chase low-yield work.

The Shift CFOs and RCM Leaders Are Making—Now

High-performing providers are responding to this reimbursement pressure by rethinking AR management—by moving from labor-led AR toward revenue intelligence–led AR, where effort is guided by insight, not just age, and every outcome is tied to ROI-focused prioritization.

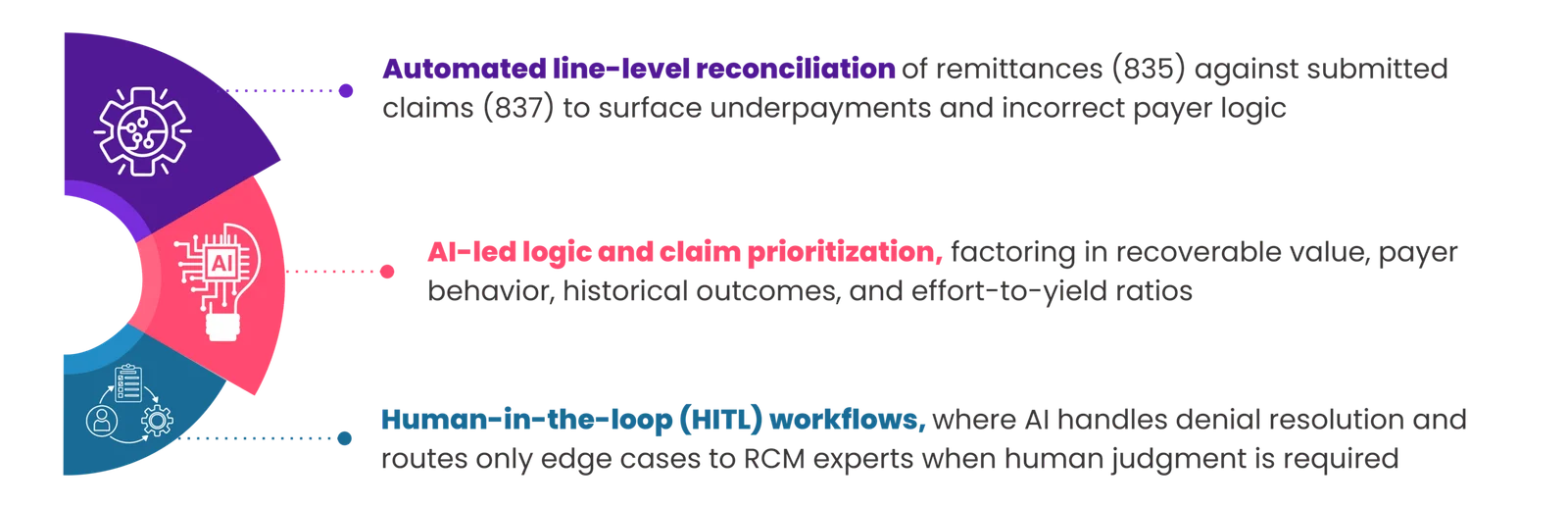

And it isn’t mere automation; it’s autonomous decision-making too, with three capabilities traditional workflows lack:

- Line-Level Financial Intelligence

Instead of treating claims as single units and relying on manual reviews, a revenue intelligence-led RCM solution reconciles 837 claim lines against 835 remittance lines, automatically detecting:

- Underpayments

- Incorrect adjustments

- Contractual variances

This is where the majority of silent revenue loss happens.

- ROI-Driven Claim Prioritization

Rather than working claims by age or status, revenue intelligence-led systems prioritize claims based on:

- Recoverable value

- Success likelihood

- Payer-specific behavior

This ensures effort is applied where it actually moves cash.

- Feedback Loops That Prevent Future Loss

AI-powered revenue intelligence doesn’t stop at recovery. It continuously analyzes:

- Denial reasons by payer, CPT, modality, and site of service

- Underpayment patterns tied to specific workflows

- Revenue risk earlier, before claims age into AR

And then feed those insights upstream—into front-end (prior authorization and eligibility verification) and mid-cycle (coding) processes—reducing future denials and payment variance.

How Jindal Healthcare’s Revenue Cycle AI Mitigates These Risks

Jindal Healthcare’s revenue intelligence platform is built specifically for high-volume, high-friction, high-scrutiny reimbursement environments like Medicare Advantage.

It operates across three layers of AR workflows, supporting RCM teams through:

In parallel, it continuously analyzes denial and payment behavior by payer, CPT, modality, and ordering patterns—feeding insights back into front-end and mid-cycle workflows for proactive denial prevention.

The result is not just faster revenue recovery at a lower cost but fewer RCM issues cascading downstream later due to its continuous learning loop.

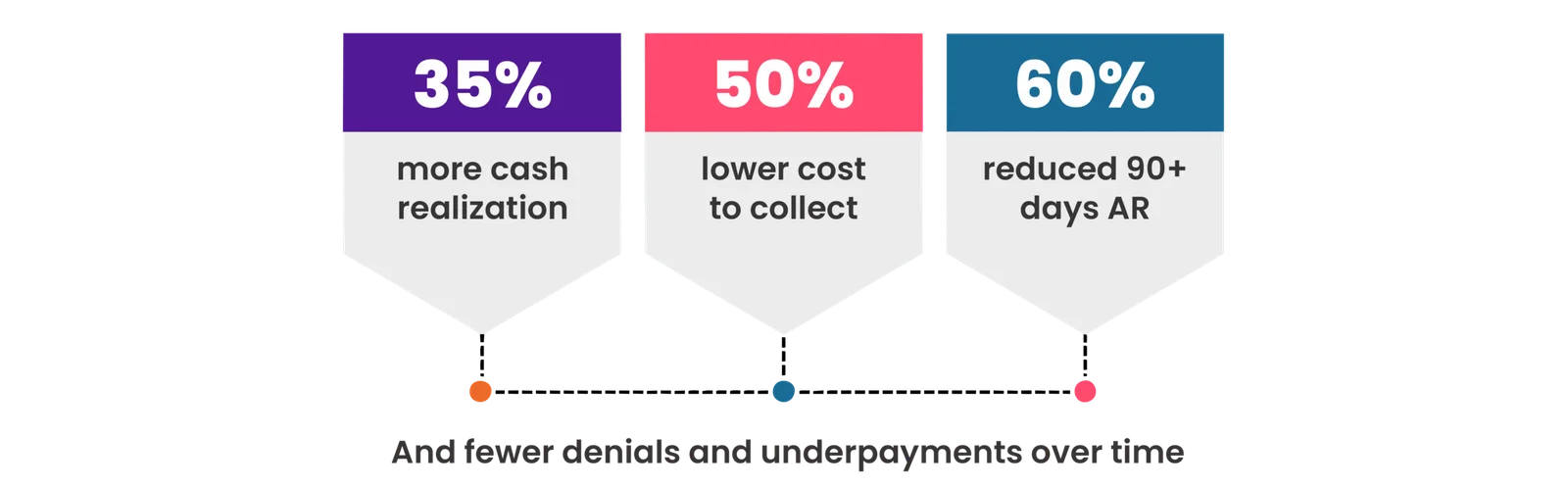

Organizations leveraging revenue intelligence-led RCM workflows report:

The Path Forward for Healthcare CFOs and RCM Leaders

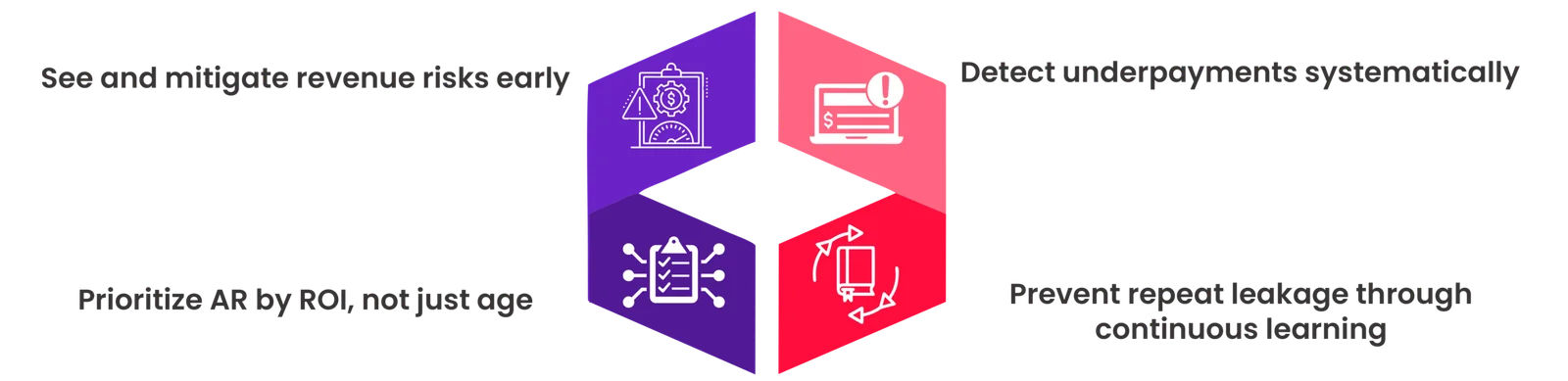

For healthcare providers, the proposed Medicare Advantage payment outlook is clearly suggestive of continued margin pressure, more aggressive claim scrutiny, and greater volatility in cash flow. They must, therefore, leverage revenue intelligence to:

Let’s Compare Notes

AR in RCM isn’t about doing more follow-ups or hiring more staff to clear backlogs anymore. It’s about seeing where revenue is leaking, prioritizing intelligently, and protecting cash in an increasingly payer-driven environment.

If you’re evaluating how to reduce denials, uncover underpayments, and stabilize AR performance—without adding administrative burden—we’d welcome the conversation.

Schedule a brief expert consultation to explore how intelligence-led RCM can help ensure you’re paid correctly, faster, and at a lower cost.

Because reimbursement pressure isn’t going away. The real question is whether your AR strategy is built to handle it.