Blind Spot KPIs Hiding in Plain Sight

Not too long ago, revenue cycle management (RCM) was a low-key backend function to keep the mission of care going. But not anymore.

Industry shifts, growing payer unpredictability, and rising staffing shortages have pulled RCM into the boardroom spotlight. It now sits alongside other priorities for healthcare leaders.

With margins getting thinner and costs going through the roof, providers can no longer afford to downplay RCM efficiency. They have realized that their organization’s financial health is directly tied to their revenue cycle efficiency and how well they track and act on RCM key performance indicators (KPIs).

But here’s the catch: RCM is flooded with data, and there’s no dearth of metrics to track. Too often, it’s easy to get distracted by surface-level reporting and lose sight of the “true” KPIs that reveal the actual health of your revenue cycle.

That’s why driving improvements isn’t about drowning in data. It’s about tracking and acting on the right RCM KPIs that go beyond vanity reporting to tell whether your revenue cycle is on track or heading for chaos and that serve as strategic enablers for financial growth.

Why These Big 4 KPIs Stand Out

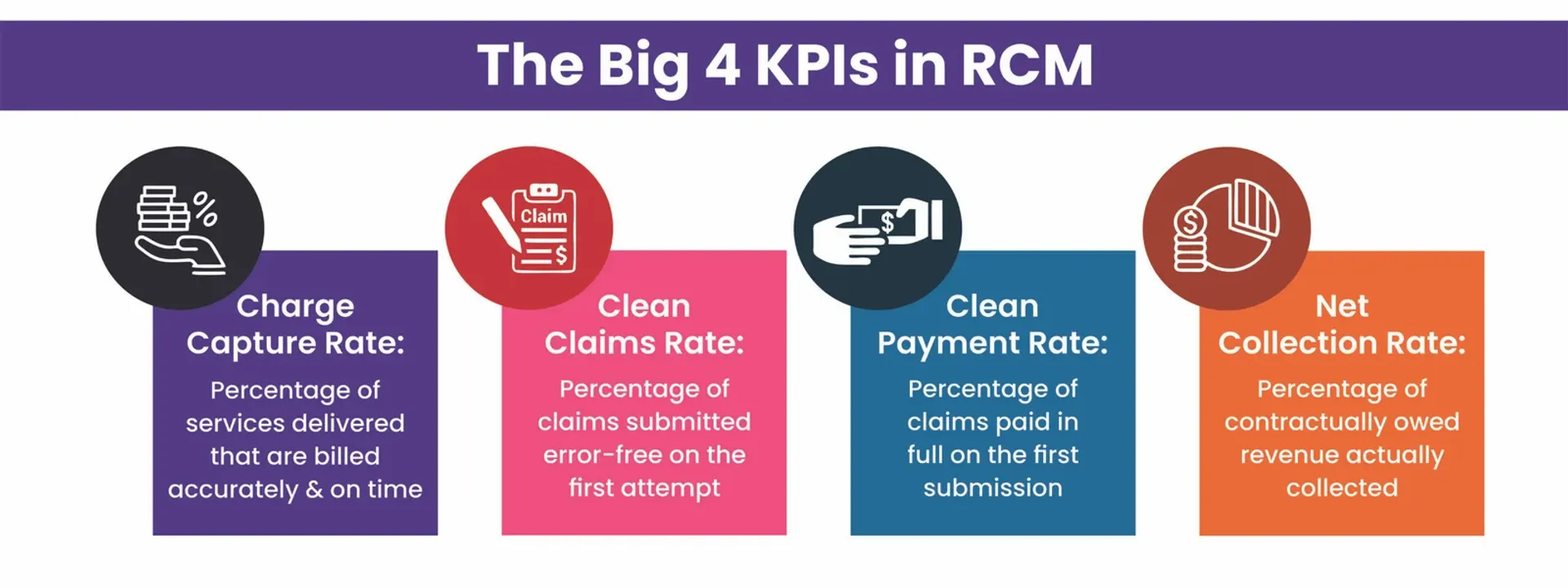

We call them the Big 4 KPIs in RCM, as they stand out for their overarching ability to provide a 360-degree view of your revenue cycle health, factoring in the complete patient-to-payment journey.

From gauging your claims processing accuracy to understanding your collections against what you’re owed, these KPIs reveal your revenue cycle’s fundamental health and can help you uncover:

- Workflow bottlenecks

- Sources of revenue leaks

- Preventable claim denials

- Gaps in your RCM technology stack

When interpreted correctly, they not only tell you where your revenue cycle is struggling but also help unlock opportunities to boost efficiency with the right intervention – whether through automation, AI enablement, agentic AI deployment, subject-matter expertise, or a mix of these.

The Big 1: Charge Capture Rate – The Revenue Integrity Anchor

By definition, the charge capture rate tells you the percentage of services accurately captured and billed for reimbursement.

On the surface, it answers a seemingly simple question: Are you billing for every service you’ve delivered and capturing every detail that’s needed for payment accurately and on time?

And you know If you haven’t, you are bound to lose your revenue downstream, no matter how strong your other RCM processes are. Objectively put, if it’s not in your claim, it’s never making it to your bank.

Industry Benchmark: 95% or higher

Pain Point: In busy healthcare environments, even small lapses in documentation can cripple the whole process and can snowball into huge revenue losses. Error-prone manual workflows and siloed processes often increase the odds of charge capture issues, including coding errors and missed charges.

Thus, to leave no room for such errors and ensure no encounter is left unbilled, healthcare providers are increasingly turning to AI-enabled RCM. AI-led RCM systems can help flag missing encounters, tighten documentation workflows, and boost front-end and mid-cycle accuracy, so every charge is captured accurately, leaving no scope for revenue to slip through the cracks.

The Big 2: Clean Claims Rate – The RCM Efficiency Multiplier

The clean claims rate measures the percentage of claims that pass through the clearinghouse on the first submission, without requiring any intervention for correction.

This KPI tells you about the accuracy of your claims process – the error-free, clean, complete, on-time, payer-compliant submissions you make.

Industry Benchmark: 95% or higher

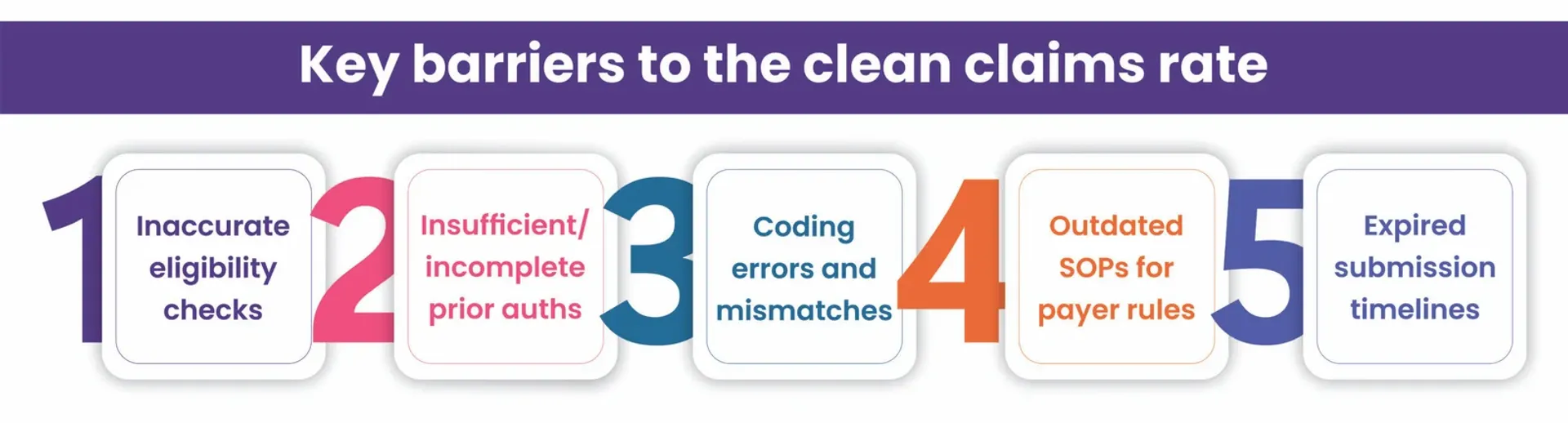

Although the industry benchmark for the clean claims rate stands at 95% or higher, many providers hover between 75% and 85% due to systemic inefficiencies in their RCM workflows.

Thus, addressing these problems early, sometimes even before the patient visit, is critical. AI-powered eligibility verification and prior authorization can help providers capture accurate information and ensure complete documentation, while expert-led payer-specific claim edits before submissions can help improve the clean claims rate, paving the way for fewer rejections and faster payments.

The Big 3: Clean Payment Rate – The True Measure of Your Payer Understanding

The clean payment rate goes beyond the clean claims rate to tell you if you got paid in full on the first submission itself, without any follow-up.

It typically tells you about your pay cycle and follow-ups, revealing whether the claim was accepted for payment in the end and not just whether it was sent without errors.

And this is where your payer understanding also comes into picture to tell you how up to date your SOPs are with payer rules.

To put simply, this KPI fast-tracks your revenue cycle, with no rejections indicating faster payments and fewer touchpoints indicating reduced cost to collect.

Industry Standard: 60% or higher

Pain Point: Payer rules are in constant flux. Without regular SOP updates, you are bound to face rejections and face payment delays in the process.

Thus, to enhance the clean payment rate, you need to:

- Regularly update your SOPs contextual to your payer intelligence

- Focus on building leaner and intelligent workflows for cleaner submissions

By doing so, you can improve your clean payment rate and break free from the follow-up cycle that adds to your RCM touches and costs.

The Big 4: Net Collection Rate – The Bottom-Line Barometer

If you could track only one RCM metric to gauge your bottom line, net collection rate would be it. This KPI essentially measures your actual collections against what you’re contractually owed. In other words, it is the litmus test to gauge your RCM efficiency and whether all your efforts have paid or not.

Industry Benchmark: 95% or higher when reached within 6 months

The industry benchmark for the net collection rate stands above 95%, which means if you’re meeting this benchmark, you’re successfully turning your claims into collections.

Pain Point: A low net collection rate means you’re working harder, but it’s not yielding you the ROI. Practices often fail to reach this benchmark due to factors like missing contracts, no underpayment identification, and partially payments accepted as paid correct. This loss of revenue often results in healthcare providers losing their financial sustainability and credibility with payers.

That’s why AI-supported revenue intelligence platforms for smarter AR analytics, claim prioritization based on ROI, and appeal success tracking have become non-negotiable for healthcare providers to maintain higher net collection rate.

Turning These KPIs into Cash Flow

It’s 2025 and payer rules are changing faster than ever. Thus, healthcare leaders need to move beyond tracking these KPIs and start acting on them to boost their RCM efficiency and cash flow.

This, however, demands a convergence of:

- Streamlined, connected, and well-integrated workflows

- Process augmentation with the 3As: AI, automation, and analytics

- Revenue cycle expertise for edge cases and high-impact tasks

The Jindal Healthcare Advantage – The Intersection of Metrics, Meaning, and Momentum

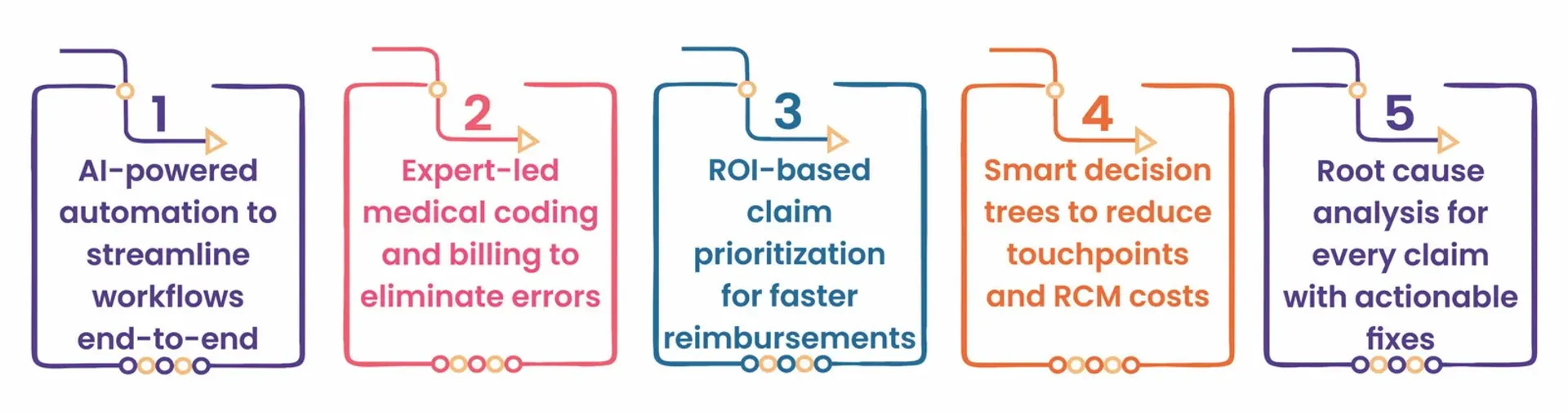

At Jindal Healthcare, we just don’t track these Big 4 KPIs on dashboards; we move them in the right direction to financially uplift your revenue cycle.

Our modus operandi is simple: measure the metrics, decode their meaning, and take steps to keep the revenue momentum going.

By combining our proprietary AI-powered RCM suite with deep industry expertise, we bring:

With AI-enabled and expert-led workflows across patient access, billing, and AR management, we not only hit the industry benchmark for these Big 4 KPIs but also exceed them by

Lead with the Big 4 RCM KPIs

These KPIs aren’t just operational measurements; they’re the storyline of your revenue cycle’s health. When paired with the right technology and expertise, they become the value levers that drive your growth.

Ready to Find Out What Your KPIs Say About Your RCM?

Book a financial health assessment with Jindal Healthcare to turn these metrics into momentum for your revenue cycle.