With Medicare and Medicaid underpayments reaching $130 billion in 2022 and claim denial rates hovering near 12%, it’s no surprise that healthcare revenue cycle management (RCM) leaders are zeroing in on accounts receivable (AR) workflows as their top priority in 2026.

The financial stakes have never been higher, and the cost of not acting with intelligence-led RCM could be even higher.

If these numbers don’t force a rethink of how AR is managed in healthcare, nothing will:

- Initial denial rates hit 11.81% in 2024, up 2.4% from the prior year.

- Hospitals lose $65,000 for every $1 million in net patient revenue due to preventable denials and rework.

- Nearly 3% of net patient revenue is lost annually to undetected and unrecovered underpayments.

- Revenue cycle inefficiencies cost U.S. hospitals $262 billion annually.

Perhaps most telling: 54.3% of claims denied by private payers are ultimately overturned on appeal. Yet appealing denials costs around $118 per claim (MGMA), creating an administrative burden that many revenue cycle teams can’t sustain.

The takeaway is hard to ignore: poor AR management in healthcare has never been more expensive—or more risky.

Why AR Has Become the Pressure Point in Revenue Cycle Management

For most healthcare RCM leaders, AR is the clearest indicator of financial health and, paradoxically, the most misunderstood and mismanaged one too.

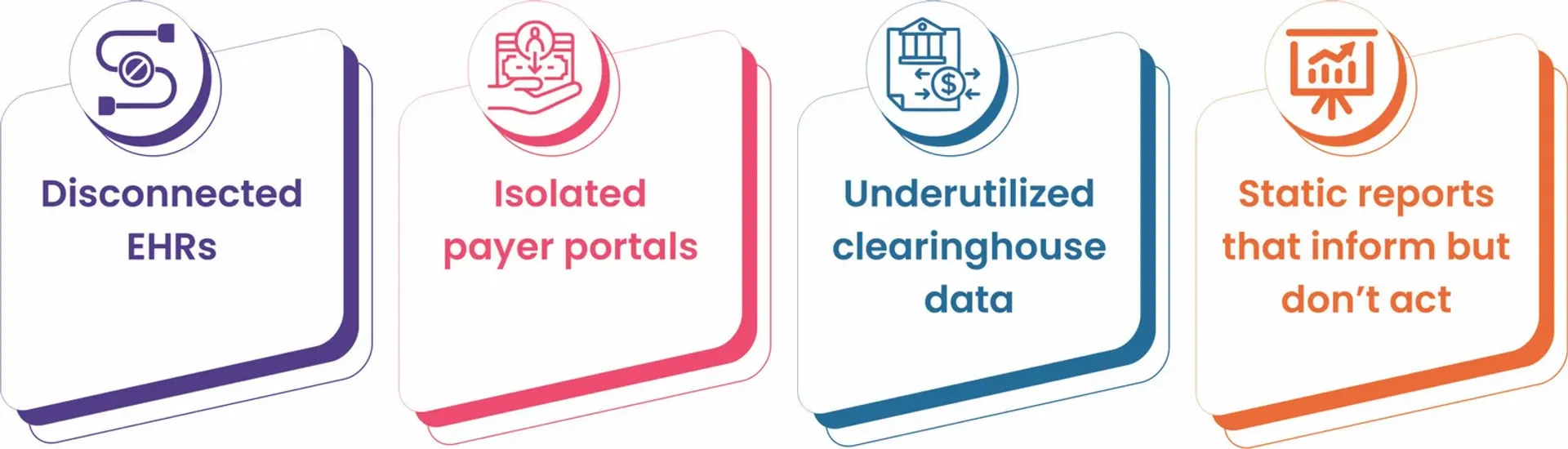

Tracked obsessively and discussed endlessly, AR workflows in healthcare are still managed much the way they were a decade ago, with RCM teams relying largely on:

What revenue cycle leaders often fail to realize is that traditional AR playbooks and methods aren’t built for today’s payer behavior, denial complexities, and operational realities where underpayments are harder to spot and appeals are costlier to sustain.

In 2026, revenue cycle leaders must move beyond knowing how much AR they have to how intelligently they manage it.

And that shifts starts by answering these five critical AR questions in 2026 and knowing how true RCM intelligence can address them:

Question 1: Do We Know Which AR Is Recoverable and Should Be Worked?

Most RCM teams treat AR as a uniform pool of revenue recovery opportunity. If a claim is open, it gets worked.

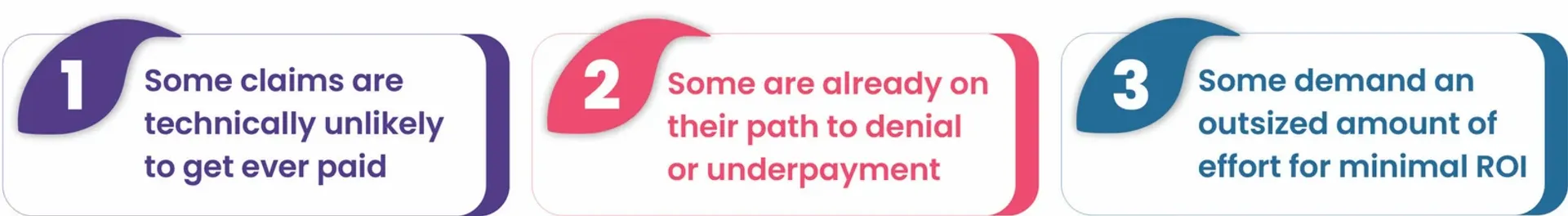

What they don’t realize is that not all AR is worth the effort:

Without AI-driven AR management, teams spend effort blindly—often on low-impact claims while missing time-sensitive, high-impact opportunities.

Question 2: Can We Identify Underpayments Without Manual Forensics?

Underpayments remain one of the most damaging, and mostly invisible, sources of revenue leakage. They rarely announce themselves and often pass silently through payment posting when no intelligence-driven checkpoints are put in place.

They scale faster than RCM teams can audit, and manual forensics simply don’t work at volume.

Without at-point payment posting intelligence and visibility, underpayments are hard to detect and appeal.

Question 3: Are Denials Being Worked or Prevented?

Many organizations still focus on denial resolution for revenue recovery instead of preventing denials upstream with claim intelligence and denial root cause analysis (RCA). Not having an AI-driven feedback loop in RCM results in recurring denials and revenue loss.

An AI-powered RCA helps understand harder questions like: Why did this denial occur in the first place? Can it happen again? What needs to change upstream to stop it?

This question reframes denials from an AR workload problem into a systemic intelligence problem.

Question 4: Do We Have Answers or Just Reports?

Healthcare RCM isn’t short on dashboards; it’s short on answers, insights, and direction.

Most revenue cycle leaders bite more data than they can chew, with limited clarity on what action to take next. They operate with static, passive reports that tell what happened but not why it happened and what to do next.

Revenue intelligence-led actions, however, can help them take the right steps in the right direction for AR optimization, whether autonomously or human-assisted.

Question 5: Can Our AR Scale Without Adding Headcount?

An unavoidable reality of 2026 for revenue cycle leaders: rising AR volumes, growing payer complexities, and talent scarcity. Scaling outcomes through headcount alone is no longer viable.

This question is forcing healthcare leaders to rethink AR as an intelligence-led autonomous model where human expertise is reserved for true edge cases.

Why Traditional AR Management Can’t Keep Up Anymore

The problem isn’t about less effort on the part of RCM teams; it’s about fragmented revenue cycle workflows with limited visibility into and intelligence on AR for faster cash realization and cost optimization.

Most AR workflows in healthcare RCM still rely on:

Without a unifying intelligence layer, AR management remains mostly reactive.

What RCM in 2026 demands is revenue cycle intelligence that doesn’t just aggregate data but understands and contextualizes it to predict outcomes and orchestrate actions for maximum ROI.

How Jindal Healthcare’s Revenue Cycle AI Redefines AR Management

Jindal Healthcare’s revenue cycle AI solution functions as an operating system for RCM, delivering a glass-pane view across payment posting, AR, and analytics to answer the five AR questions with intelligence and action.

Smart AR Prioritization for Faster Cash Realization

Determines revenue recoverability on the basis of ROI, prioritizing high-impact, time-sensitive claims for faster cash realization

- Automated Underpayment Detection and Appeal Generation

Reviews incoming payments from clearinghouses against payer contracts—flagging discrepancies and generating appeals autonomously

- Proactive Denial Prevention with RCA

Traces denials to their root causes and feeds outcomes back into upstream workflows to reduce recurrence

- Intelligent Dashboards That Answer, Not Just Report

Provides explainable insights, with deep drill-downs to the nth degree, and AI-guided recommendations that clarify next-best actions

- AR that Scales Through Autonomy, Not Headcount

Automates claim status checks, follow-ups, appeals, and payer outreach—pushing only true edge cases to human experts

2026: The Era of Strategic AR Management

In 2026, AR performance will not be judged by AR days and claims worked. It will be judged by how intelligently revenue is protected and recovered.

The year will reward healthcare organizations that replace reactive processes with AI-powered RCM and revenue intelligence-led workflows for smarter, faster RCM.

Leveraging Jindal Healthcare’s autonomous RCM engine, revenue cycle teams can tap into the potential of AI in RCM that gets smarter with every claim it works.

Book a demo to see how our revenue intelligence engine transforms AR from a backlog function into a true strategic advantage for healthcare providers.