The rate at which insurers deny medical claims is quite troubling. The average claim denial rate climbed by 23% over the last four years, a recent investigation found. This results in unpaid services lost or delayed income, and a significant financial hit for medical practices.

So before criticizing insurers for refusing your claims, take a step back and consider the denial management plan. Many denials are caused by incorrect or misleading information in your claims, forcing the insurer to deny your claims and undermine your revenue flow.

Not all businesses follow up on their claim rejection, leading the claims to be written off as overwhelming debt.

But it’s not all shocking news: You can boost your organization’s claim acceptance rate to 95% or higher by implementing a strong denials management strategy.

What is Denial Management?

It’s a strategic process that resolves the problems that cause medical claim denials. The goal is to significantly reduce the risk of future claim denials, ensuring that healthcare practices are paid promptly to support a healthy cash flow.

Denial management teams find and track recurring denial reason codes and trends to identify and correct any registration, billing, or medical coding setbacks.

By proactively addressing issues, the team prevents future claim denials and maximizes the practice’s revenue. The team also analyzes patterns of individual payers to make it effortless to detect a deviation from the normal trend.

How Does Denial Management Work?

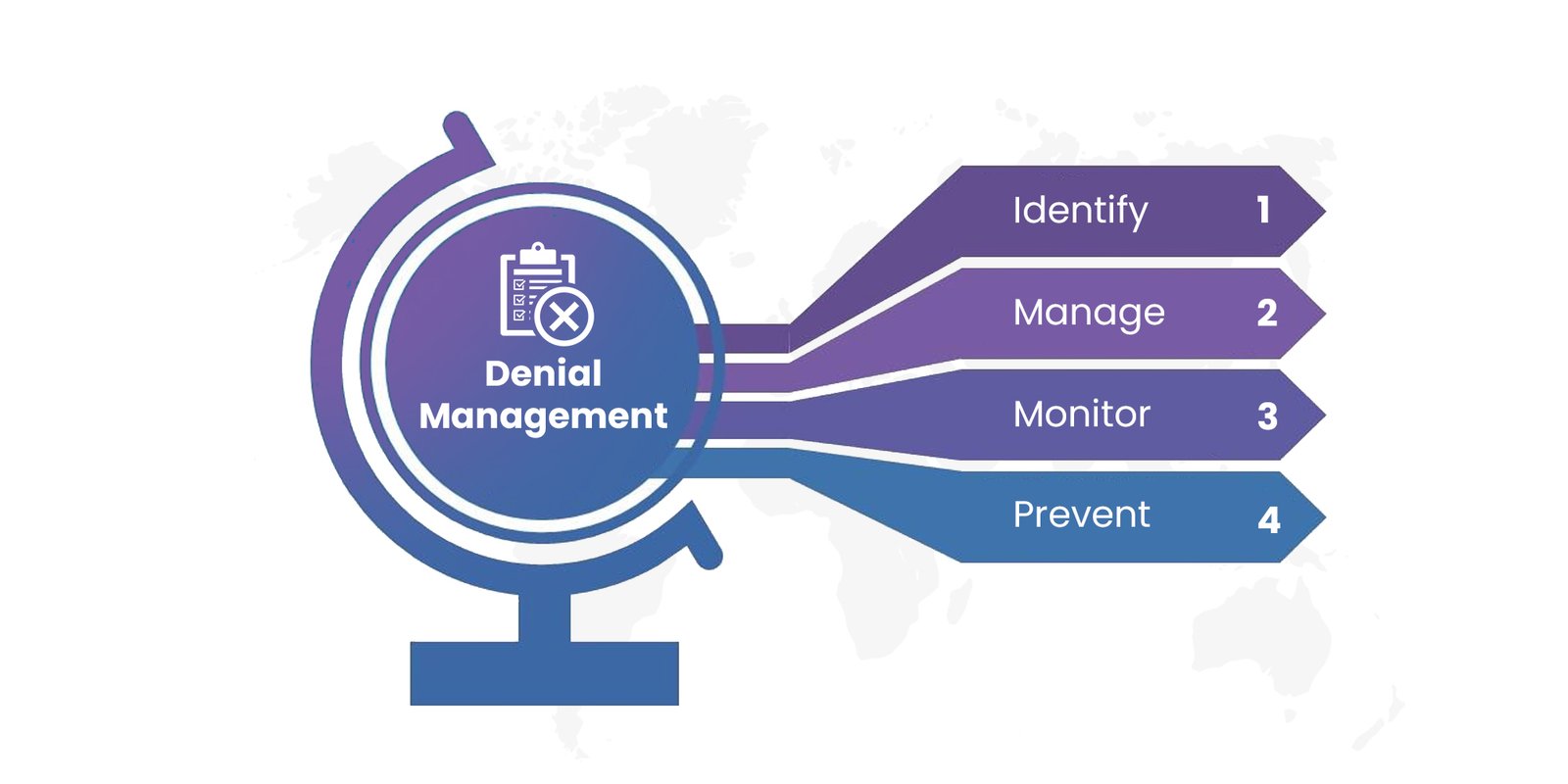

Let’s dig deeper into how this process works. It starts with a systematic technique known as the IMMP process, which stands for identity, manage, monitor, and prevent. Keep in mind that the key to success is developing repeated processes to efficiently handle claim denials in the long term.

1. Identify

The first step is understanding why the claim was denied. Insurers usually explain why the claim was denied via claim adjustment reason codes (CARCs). However, they can be difficult to understand, as some insurers use non-standard codes. So, it’s important to have experts who can help you decipher the CARCs and decide why the claim was not reimbursed.

Once you understand the reason for the denial, you can appeal against the decision and get the reimbursement your organization is entitled to.

2. Manage

Now, it’s time to get your insurance to pay the medical claim. These are the actions the denial management team usually takes:

a.) Routing Denial Directly

This involves organizing and speeding up the paperwork for denial-related info. Teams typically use automated tools to route denied transactions directly into the worklist. For example, they’ll route all coding-related denials to coders, who will act on each item quickly and efficiently.

b.) Sorting the Work

The denial management team then uses software to help them sort through their worklists by factors like amount, time, and reason. This helps make the work more organized and efficient, rather than using systems manually.

c.) Creating Standardized Workflow

Next, they will develop a standard response for every kind of refusal by:

- Noting the most typical denial reason for the clinic

- Figuring out the code that’s most often used for g that denial

- Creating a well-thought-out action plan to deal with similar denials

d.) Using A Checklist

To keep your denial management procedure as systematic and error-free as possible, a checklist goes a long way. A checklist of dos and don’ts can help your team avoid common errors that might cause rejections to stall or become uncollectible bad debts.

3. Monitor

Monitoring the denial management process is crucial to keeping everything on track and ensuring that the claim is properly approved. You’ll want to keep track of denials by type, date received, date appealed, and disposition.

Also, be sure to examine the denial management team’s work by sampling and analyzing their appeals. They should have the necessary resources and technologies to do the task efficiently and quickly.

Another tip is to push for internal dialogue with the insurer to discuss better ways of doing business and reducing future claim denials.

4. Prevent

The next step is developing a prevention campaign. To begin, review the denials again to determine the possible opportunities to retain staff, adjust workflow, and revise your processes.

This will enable you to form teams that help with claim denial. For example, if rejections are due to a registration error, gather the front desk crew and guide them through the preventative program to ensure they avoid errors that lead to claim denials again. Other types of claim denials to avoid include coding errors, insufficient authorization, and lack of medical necessity.

Why Does Denial Management Matter for Your Healthcare Organization?

It’s crucial to ensure that your insurance claim is exact, complete, and processable by the insurance provider to prevent your business from losing revenue. There are several reasons why you should consider including denial management in your practice:

a. Pinpoint areas that require improvement to prevent denials in the future.

b. Promptly track, prioritize, and appeal denials.

c. Determine the underlying causes of claim denial issues, and create a long-term solution.

d. The appeal through denial management to increase the claim amount.

Conclusion

The importance of effective denial management cannot be overstated for healthcare practices.

By adopting a comprehensive strategy encompassing identification, management, monitoring, and prevention, organizations can minimize claim denials and ensure prompt payment, financial stability, and improved revenue streams. Through proactive measures such as analysis of denial patterns, workflow optimization, and staff training, healthcare practices can mitigate future risks and achieve higher claim acceptance rates. Investing in denial management not only safeguards against financial losses but also promotes operational efficiency and enhances patient care delivery.

Jindal Healthcare’s commitment to streamlined claim processing, maximum reimbursement, and financial stability empowers organizations to perfect revenue streams and deliver unparalleled patient care, reinforcing their position as industry leaders in healthcare management.