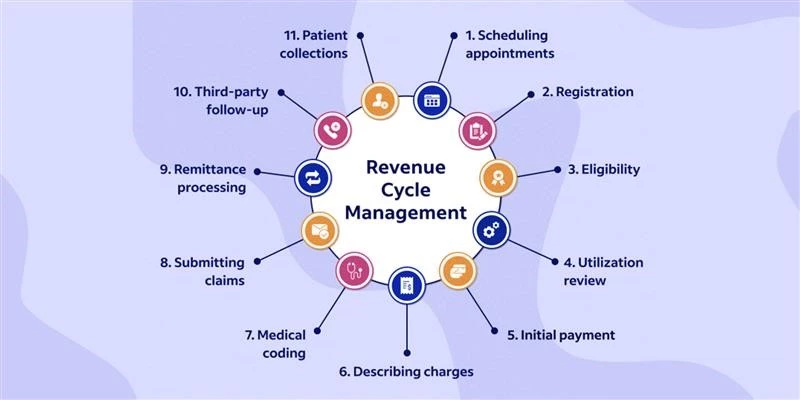

Your practice’s revenue cycle management (RCM) involves various interconnected elements. Among them, accounts receivable (A/R) stands out as a crucial component. It is essential to track and enhance accounts receivable in healthcare to establish a thriving and financially stable practice.

To improve your accounts receivable management process, it is essential to proactively manage your revenue cycle and address any operational inefficiencies. By focusing on optimizing administrative processes, generating comprehensive AR reports, and diligently tracking claims, healthcare providers can recover revenue that would otherwise be lost. If aging A/R starts accumulating, healthcare providers may consider exploring the option of outsourcing reimbursement collection to a specialized revenue cycle management (RCM) company. Now, let’s delve into these strategies in more detail.

What is an Account Receivable (A/R)?

Healthcare account receivable management or A/R refers to the outstanding payments owed to a healthcare practice or organization for services rendered to patients. It represents the amount of money that is due from insurance companies, government payers, and patients themselves.

As the AR goes unpaid for a longer duration, healthcare providers are less likely to receive full payment. After 120 days, clinicians can expect to receive only ten cents per dollar owed. The AR cycle begins when healthcare providers submit bills to patients or their insurance companies.

However, despite indicating the amount owed, A/R does not qualify as assets. Providers typically categorize accounts receivable based on their age:

- 1-30 days

- 31-60 days

- 61-90 days

- 91-120 days

If reimbursement is not collected promptly, it prolongs the AR cycle and increases the risk of revenue leakage. Efficient management of accounts receivable helps maintain a steady cash flow, meet financial obligations, enhance patient relationships, and optimize operational efficiency. To conclude, accounts receivable is crucial for the financial viability and success of healthcare practices.  Challenges with Healthcare Accounts Receivable Management

Challenges with Healthcare Accounts Receivable Management

Several challenges persist in the realm of A/R management in healthcare:

1. Complex Billing and Reimbursement

The healthcare industry’s billing and reimbursement processes are multifaceted, involving various stakeholders such as insurers, government agencies, and third-party payers. Each payer has its own specific requirements, billing codes, and documentation standards, which can lead to errors and delays in processing claims. Navigating through these intricacies demands a high level of expertise and resources, often resulting in the need for specialized staff to manage the A/R effectively.

Moreover, healthcare regulations and guidelines are subject to frequent changes, making it crucial for healthcare organizations to stay updated and compliant. The organization’s cash flow could be significantly impacted by claim denials and delayed payments if these modifications are not followed.

2. Administrative Burden

The management of A/R in healthcare involves extensive administrative efforts, ranging from verifying patient insurance information to tracking claim statuses and handling denials. Healthcare providers must diligently follow up with payers to resolve any issues that may arise during the reimbursement process. Additionally, managing patient billing, processing payments, and handling inquiries regarding bills demand considerable time and resources.

As healthcare organizations face increased administrative tasks associated with A/R management, physicians and staff may find themselves pulled away from their primary focus of providing quality patient care. This can result in added stress and reduced job satisfaction, potentially impacting the overall quality of healthcare services.

3. Rising Patient Responsibility

The shift towards high-deductible health plans has significantly increased the financial responsibility placed on patients. With higher deductibles, copayments, and coinsurance, patients now bear a more substantial portion of their healthcare expenses. As a result, healthcare providers often face challenges in collecting payments directly from patients.

The rising patient responsibility can lead to increased instances of unpaid or delayed balances, impacting the organization’s revenue cycle and cash flow. To address this challenge, healthcare providers must improve their patient communication and collection processes, ensuring transparency about costs and providing flexible payment options.

How to Improve Accounts Receivable (A/R) Management?

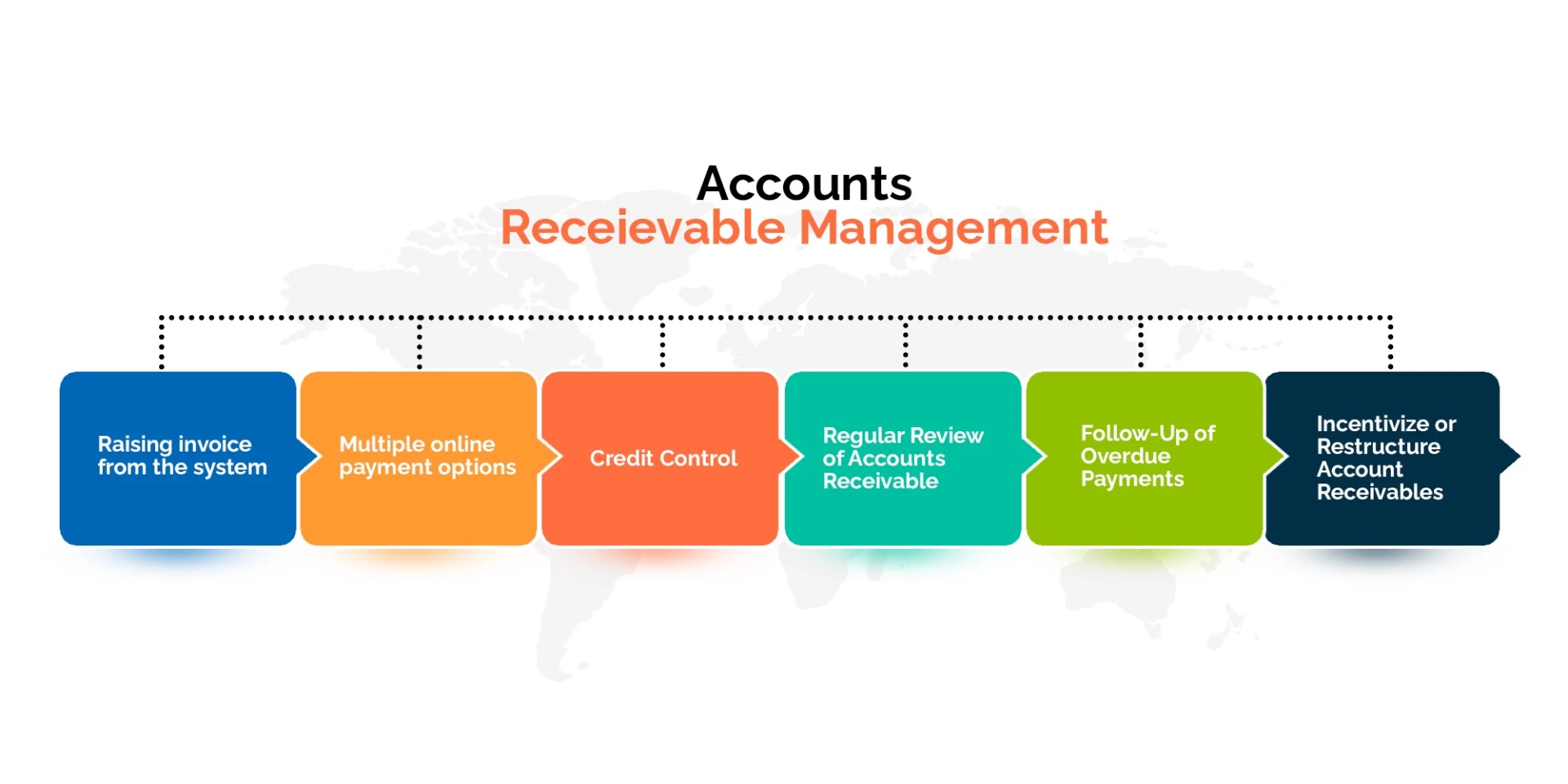

Improving healthcare accounts receivable management requires implementing effective strategies to optimize the revenue cycle and enhance payment collection. Here are some strategies that can help:

a) Streamline Billing Processes: Simplify and standardize billing procedures to reduce errors and improve efficiency. Ensure accurate coding, complete documentation, and timely submission of claims to insurance companies and payers.

b) Clear and Transparent Patient Communication: Clearly communicate billing policies, payment expectations, and any financial responsibilities to patients. Provide easy-to-understand billing statements and offer various payment options to facilitate timely payments.

c) Implement Timely Follow-up: Establish a systematic follow-up process for unpaid claims or outstanding balances. Track and address denials, rejections, and appeals promptly. Timely and persistent follow-up helps expedite payment collection.

d) Proactive Denial Prevention: Identify common denial patterns and proactively address them. Analyze denial trends, implement necessary changes in billing practices, and collaborate with payers to resolve recurring issues.

e) Optimize Revenue Cycle Management (RCM): Consider outsourcing RCM to specialized companies that have expertise in managing accounts receivable. They can handle tasks such as claim submission, denial management, and payment posting, allowing healthcare practices to focus on patient care.

f ) Educate and Train Staff: Ensure that billing and administrative staff are well-trained in best practices, coding requirements, and billing regulations. Ongoing education and training help improve accuracy, reduce errors, and enhance overall accounts receivable management.

Trends and Predictions for Healthcare Accounts Receivable Management

The future of A/R management in healthcare holds promising trends that aim to address existing challenges and improve overall efficiency:

- Automation and Technology Integration: Healthcare providers are increasingly adopting advanced technology solutions to automate their accounts receivable management process. Machine learning (ML), artificial intelligence (AI), and robotic process automation enable faster claims processing, accurate coding, and real-time eligibility verification, reducing administrative burdens and increasing revenue cycle efficiency. Automation and AI can significantly ease out various tasks in healthcare revenue cycle management (RCM) such as claims processing, coding accuracy, denial management, payment posting and more leading to notable improvements in efficiency.

For instance, at Jindal Healthcare, we use our proprietary AI-based tool, HealthX 2.0, to analyze a practice’s EHR and automate various revenue cycle processes. Through this advanced technology, we generate analytical data that is presented in result-oriented operational flows using Power BI. These flows aid in identifying straightforward claims, reducing errors in medical billing and coding, prioritizing claims, expediting revenue generation, minimizing denial rates, and enhancing the efficiency of claims submission.

2. Patient-Centric Approach: As patient responsibility continues to rise; healthcare organizations are shifting their focus towards enhancing the patient’s experience. This includes providing transparent pricing, offering convenient payment options, and implementing self-service portals for bill payment and financial assistance applications.

3. Data Analytics and Predictive Modeling: Leveraging data analytics and predictive modeling can help healthcare organizations identify trends, predict payment patterns, and optimize revenue cycle performance. By analyzing historical data and patterns, providers can streamline their A/R processes, reduce denials, and proactively address potential issues.

4. Telehealth Impact: The continued growth of telehealth services will also impact A/R management in healthcare. As telehealth becomes a more significant part of the healthcare landscape, providers will need to adapt their revenue cycle processes to accommodate virtual visits, billing, and reimbursement for remote services.

5. Outsourcing and Revenue Cycle Management Partnerships: Many healthcare organizations are turning to outsourcing and forming partnerships with specialized revenue cycle management firms. These partnerships offer access to expertise, advanced technology, and streamlined processes, allowing providers to focus on patient care while improving A/R outcomes.

6. Regulation and Compliance: Healthcare organizations will need to stay updated with ever-changing healthcare regulations and compliance requirements, especially concerning billing and reimbursement. Keeping abreast of these changes and ensuring compliance will be crucial to avoid penalties and financial losses.

Conclusion

In the rapidly changing healthcare landscape, embracing new trends in accounts receivable management is crucial for the financial well-being of healthcare organizations. Automation, patient-centric approaches, data analytics, and strategic partnerships all contribute to streamlining the accounts receivable management process, reducing costs, and improving revenue cycle performance. By adopting these trends, healthcare providers can overcome the challenges associated with A/R management and create a more efficient and financially stable future.